Long associated with vegan and vegetarian diets, the market for plant-based meat substitutes in Poland has already reached a value of PLN 1.5 billion and will become an increasingly important part of the food segment due to growing awareness of health and environmental issues.

Global food industry trends

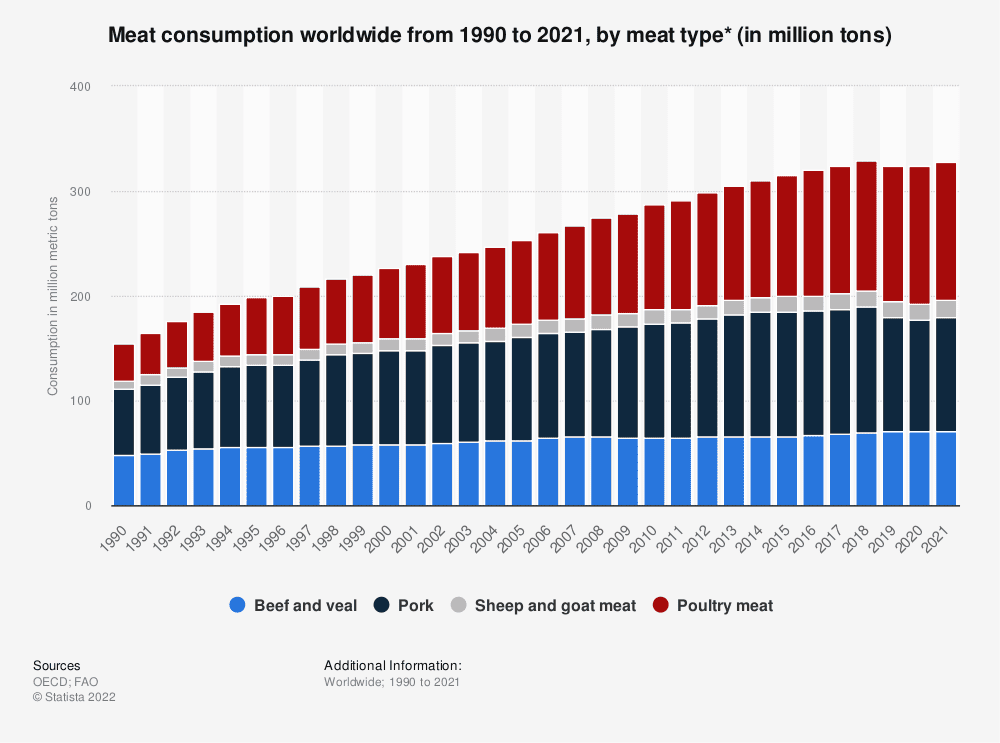

The global economy is facing major challenges related to sustainability, which includes both environmental and social issues. While much of the sustainability discussion to date has focused on fossil fuels and the overuse of natural resources, with the formulation of the Sustainable Development Goals in 2015, it is beginning to include less popular issues as well. One of these is the topic of excessive meat production and consumption and the impact of this on both the environment and human health.

Although foods of animal origin, such as meat, milk and eggs, are high quality sources of nutrients and micronutrients (including iron, zinc and vitamin B12), the over-consumption of animal products contributes to a growing number of problems. According to most dietary guidelines, meat consumption for the average adult should not exceed the equivalent of about 30 kg per year. However, in many developed countries, annual per capita meat consumption is a multiple of this value; in 2017, this was 151 kg in Portugal, 146 kg in the United States and 99 kg in Poland. This, in turn, contributes to an increase in lifestyle-related diseases of civilisation, such as cardiovascular disease, type 2 diabetes and colorectal cancer.

The second set of issues related to excessive meat consumption is related to its negative impact on the environment. Animal husbandry is responsible for about 14.5% of the world’s total carbon dioxide emissions and occupies indirectly (including animal feed production) up to 77% of the total area of agricultural land. As mankind obtains only 18% of all calories from meat, this means that its current level of production is extremely energy inefficient, making it difficult to achieve the decarbonisation goals for 2030 and 2050.

In the context of the above, it is therefore good news that, over the last few years, the European plant-based food sector has been growing by several tens of percent each year. In Poland, sales of meat substitutes doubled between 2020 and 2021, and their market reached a value of PLN 1.5 billion in 2022. Although for many years they were mainly associated with vegetarian and vegan diets, it is now also increasingly common to hear the term ‘flexitarianism’, or flexible vegetarianism. Such a diet allows the consumption of meat but seeks to limit its consumption for the sake of one’s health and the environment.

Consumer perspectives

Marcin Tischner, Corporate Engagement & Sustainability Specialist at ProVeg, emphasises that the market for plant-based meat alternatives is currently being boosted by the fact that their price level is increasingly approaching that of meat and dairy, and sometimes plant-based products are even becoming the cheaper option. Reaching price parity will therefore represent a significant turning point for the meat substitute market, as it will potentially open up to most consumers, not just the dietarily and environmentally sensitive.

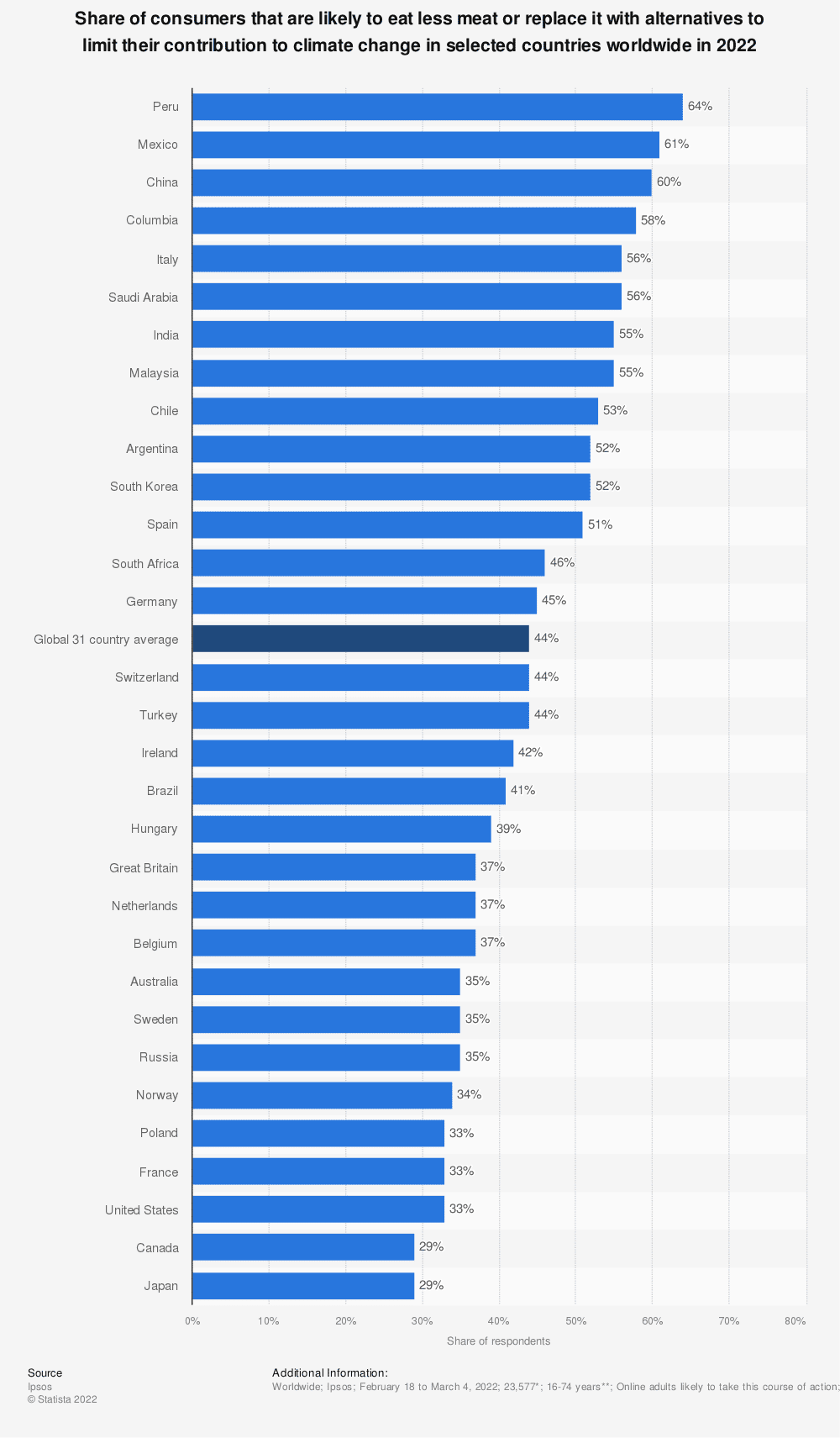

According to a study by researchers from the Poznań University of Economics, reducing meat consumption and thus switching to a flexitarian diet is already declared by up to 57% of students, compared to the national average of 39%. This means that younger generations of consumers are paying increasing attention to environmental issues and are likely to contribute to the further dynamic growth of the market for meat substitutes.

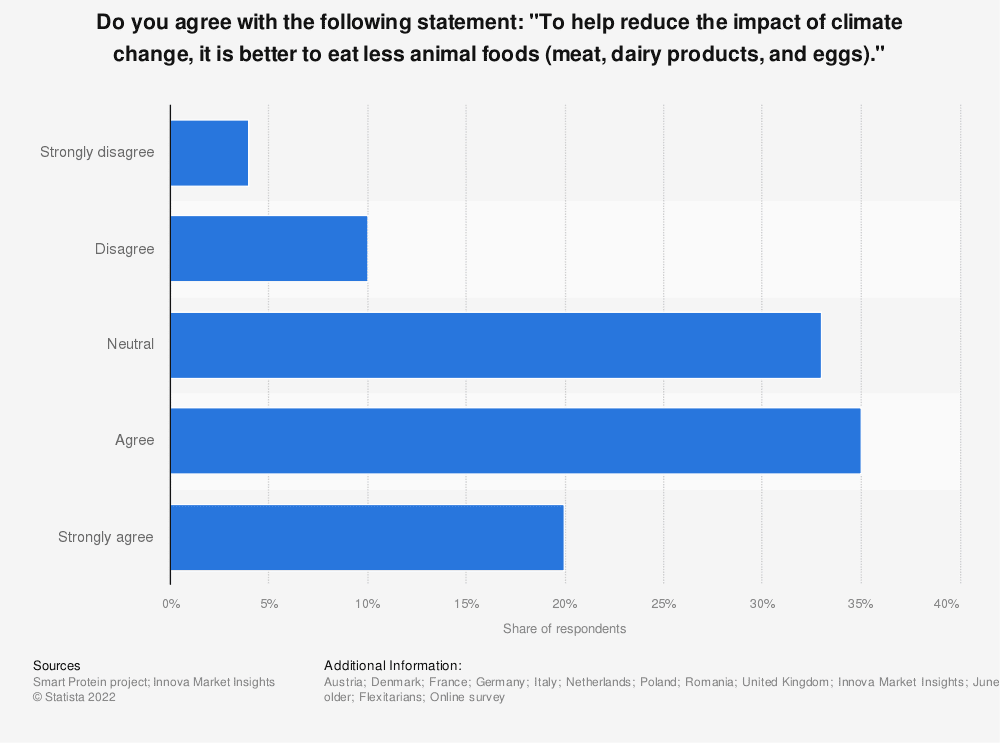

As shown in the graph above, more than 50% of people interviewed from all over Europe believe that reducing animal products consumption will indeed have an impact on climate change. Notably, less than 15% does not agree with the assumption.

The growing importance of plant-based meat substitutes is in turn influencing companies’ strategies. Ikea has announced that by 2050, half of the meals offered in its restaurants will be of plant origin – Burger King has also made the same pledge to meet by 2030. Supporting a plant-based diet is also announced by Nestlé, which plans to achieve net zero emissions by 2050. Assumptions to increase sales of plant-based meat alternatives are also announced by corporations such as Unilever and Tesco.

According to analysts at the Boston Consulting Group, the market for plant-based meat substitutes will therefore continue its buoyant growth for the foreseeable future, attracting the attention of investment funds – both those describing themselves as ‘green’ and Venture Capital – over time. Thus, another market will see companies acting in line with the European Green Deal and ESG principles – as solutions that are beneficial to both business and the environment will be essential to achieving the EU’s ambitious 2050 targets.

Overall, as the statistic above shows, in Poland the population is still anchored to a traditional meat-based diet and the majority of respondents interviewed is not considering changing his nutritional habits. Only 33% of people is in fact willing to reduce or replace meat consumption compared to a 44% global average. Although this trend could change in the future, as young generations bring about a cultural change more reflected on environmental topics, meat consumption is still a dominant component of the Polish food market.