Sergiu Mitrescu – New Strategy Center

Sergiu Mitrescu is Program Director at the New Strategy Center and University of Birmingham graduate with an undergraduate Degree in International Relation and a Master’s Degree in Security Studies. His research covers the strategic role of energy, with a particular focus on the security of critical offshore energy infrastructure and maritime security.

This contribution is part of the book “The Dragon at the Gates of Europe: Chinese presence in the Balkans and Central-Eastern Europe” (more info here) and has been selected for open access publication on Blue Europe website for a wider reach. Citation:

Mitrescu, Sergiu, China’s (lack of) presence in Romania’s strategic sector: Regional outlier or historical path dependency?, in: Andrea Bogoni and Brian F. G. Fabrègue, eds., The Dragon at the Gates of Europe: Chinese Presence in the Balkans and Central-Eastern Europe, Blue Europe, Dec 2023: pp. 409-430. ISBN: 979-8989739806.

1. Introduction

Romania’s Peoples Republic was the third country which officially recognized the People’s Republic of China. In the late 1960s and 1970s, Sino-Soviet tensions and the Ceaușescu’s regime quest for a non-aligned foreign policy forged an alliance of convenience between the two countries. In 1968, Chinese Premier Zhou Enlai voiced support for Ceaușescu’s decision to condemn the Soviet intervention in Czechoslovakia. The zenith of the two countries’ relations occurred in 1972 when Romania played an important diplomatic role in the Sino-American reproachment.

In the 1980s the relations between the two countries were characterized by a period of inertia, with both states focusing on their internal affairs: China on its policy of opening up, Romania trying to pay its foreign debts, while sliding further into dictatorship and international isolation.

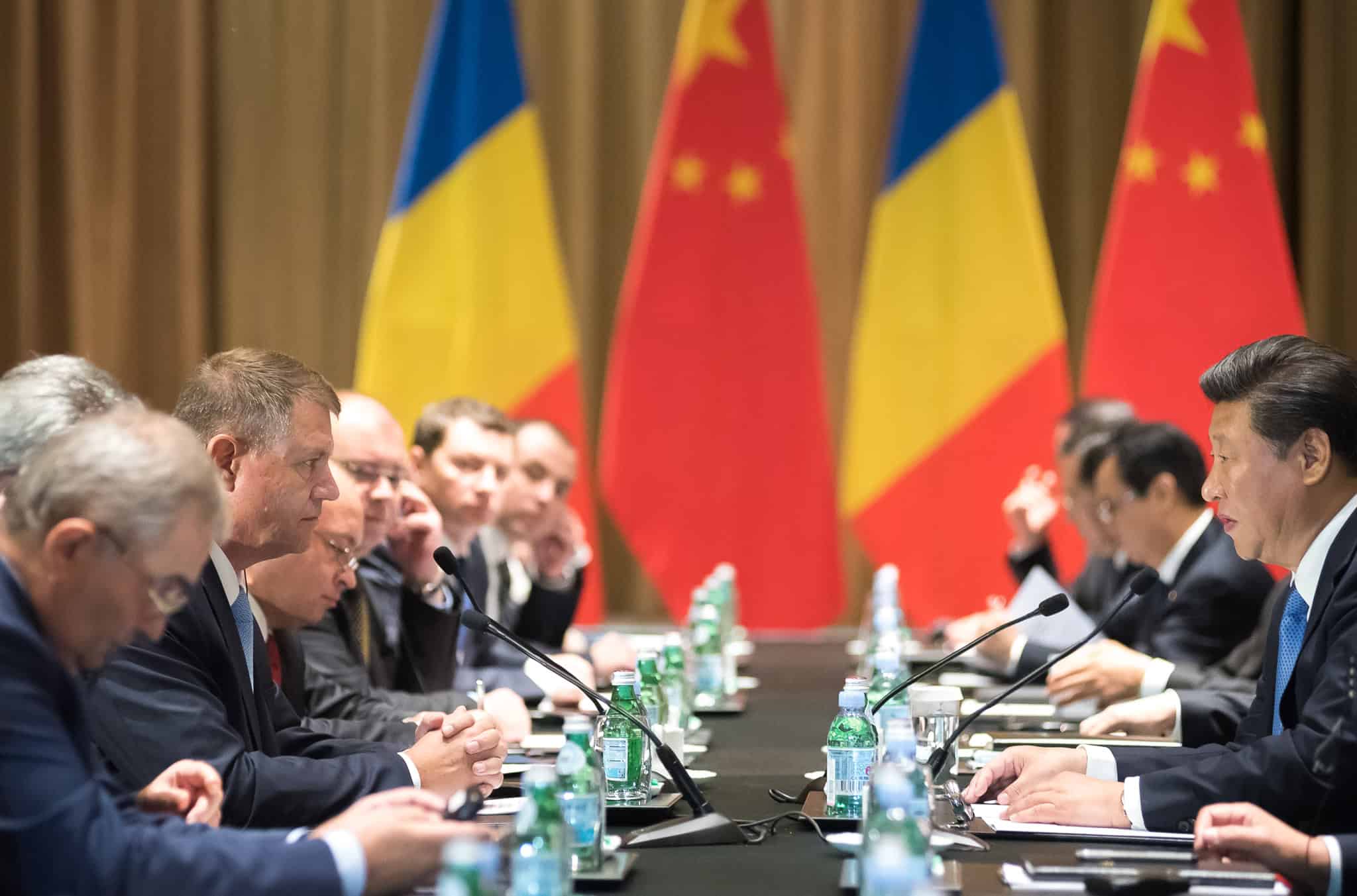

During the post-1989 Iliescu regime, Romania postponed its transition towards a free-market economy, cautiously keeping China as an ally in the hope for a return, an attitude reciprocated by Beijing. After a flurry of bilateral visits in the early 2000s culminating with Hu Jintao’s 2004 visit to Bucharest, the last Romanian head of state to visit China was Traian Basescu in 2006.

2. The long way from rhetoric to projects

The heyday of Chinese investment plans in Romania occurred during Ponta’s premiership (2012-2015), who declared in 2013 that “I want Romania to be China’s best friend in the European Union […] a political, economic, trade, cultural and artistic gateway” (Gov.ro, 2013) and a general wave of mercantile optimism sweeping Europe, perhaps best embodied by British Chancellor George Osborne 2015 declaration of the commencement a “golden age” in Sino-British economic relations (Gov.uk, 2015). Prime Minister Victor Ponta’s bombastic rhetoric was matched by a furry of investment announcements coming from Chinese companies operating abroad, making 2013 the pinnacle of rhetorical economic intimacy between the two countries.

Chinese economic incursions in the CEE region have followed an easily discernible pattern, focusing on critical infrastructure. Within this spectrum, the strategy recorded country-by-country variations, targeting the sectors most in need of investment. In Romania’s case, the efforts centred around its energy sector, built in the 1970s and 1980s to satisfy the country’s ever-increasing energy needs under Ceaușescu’s autarkic forced industrialization policy.

In 2012, China’s Huadian Engineering announced a $1 billion investment in the Rovinari powerplant, targeting a final production capacity of 500 MW (Dan, 2012). After a decade of delays and no progress on the ground, the powerplant was permanently closed in 2023 (Complexul Energetic Oltenia, 2023). A year later in 2013, a €300 million investment in the Mintia powerplant was announced (Șerbănescu, 2013). Nine years later, it was bought for €90 million by Iraqi investors (Euronews.ro, 2022). In the same seminal year for Chinese investments in Romania, Sinohydo Corporation declared its intention to invest a €1 billion at the Tarnița Lăpuștești powerplant (Adevărul, 2012). The project never materialized. On 31st of July 2023, Sebastian Burduja, the Romanian Minister of Energy declared in reference to the Tarnița Lăpuștești powerplant that the European Investment Bank’s message is that this […] is “exactly the type of project that Romania needs to implement” (Economica.net, 2023).

In 2015, the Romanian State signed a Memorandum of Understanding with China General Nuclear Power Group (CNG) for the construction of the Cernavodă Nuclear Powerplant reactors 3 & 4 (World Nuclear News, 2015). In the years leading up to the year 2019, the initiative remained declaratory, with no concrete steps taken.

2019 was a notable inflexion point in Romania’s relationship with the PRC’s economic doings in the country. Under Trump’s administration pressure, Romania signed the Huawei Memorandum, which effectively banned the Chinese tech giant from involvement in the country’s 5G network, swiftly followed by the May 2020 Romania’s state-owned Nuclearelectrica decision to repeal its 2014 Strategy of pursuing the construction of reactors 3 & 4 in partnership with China General Nuclear Power Group (Nuclearelectrica, 2014). In December 2020, Eximbank US Chairman Kimberly Reed visited the power plant together with then-US ambassador Adrian Zuckerman. Chairman Reed underlined the importance of the Cernavodă power plant, stating that its “success comes in the aftermath of the rejection of a plan for a nuclear power entity in the People’s Republic of China to undertake this project” (EXIM, 2020). The visit was swiftly followed by the decision to offer $8 billion worth of financial support for the construction of reactors 3 & 4 and the refurbishment of reactor 1 (Lupițu, 2020). In 2022, Fluor Corporation (USA), Sargent & Lundy (USA), SNC Lavalin (Canada) and Framatome (France) announced their interest in the Cernavodă Nuclear projects (Ionescu, 2022).

In parallel, the program which would see Romania be the first country outside the United States to implement the Small Modular Reactors (SMR) technology entered a new phase, partly on the back of the strategic confidence boost given by Bucharest’s decision to exclude Chinese companies from sensitive projects. In May 2023, the Department of State announced that the US issued a letter of interest for up to $4 billion in project financing, after providing $275 million to advance the Romania Small Modular Reactor Project (State.gov, 2023).

Chinese attempts to replicate its success with the Piraeus port clashed with geopolitical realities. Constanta, Black Sea’s largest harbour is located just 30km away from Mihail Kogălniceanu military base, one of USA’s pillars on the South-Eastern flank in which Romania has invested $2.5 bn to expand facilities to accommodate 10.000 personnel (Romania Insider, 2019). China’s presence in the port is limited to COFCO owning a cereal terminal, only after acquiring Nidera, a Dutch company which already owned it (Bernovic, 2014).

The trajectory of these projects over the past decade point to a clear pattern. None of the initial announcements were followed through with tangible developments on the ground. In the ensuing years, American and European funders and companies filled the gap, as in the case of Cernavodă and Tarnița Lăpuștești. Where this was not possible or feasible, the projects were simply abandoned, with Chinese investment announcements leaving no print on Romania’s critical infrastructure complex. From 2021 onwards, the Romanian government tightened the screw on Chinese investments in the country, effectively excluding Chinese companies from public tenders. In the telecommunications realm, the government in Bucharest acted on its 2019 MoU on the implementation of 5G technology, by adopting a law in 2021 regarding the implementation of the technology on the country’s territory, which effectively excluded companies registered in China from the process (CDEP, 2021). Concomitantly, Chinese companies were banned from participating in public infrastructure tenders, through the Government Emergency Ordinance No. 25/2021 which forbids from tenders any states that have not concluded commercial or pre-ascension agreements with the European Union. In doing so, the Romanian government tied the right of Chinese companies to participate in public tenders to PRC ratifying the Agreement on Government Procurement of the World Trade Organisation. As of now, the only infrastructure project which is currently being implemented by a Chinese company is a two-lane 5.5 km long road that was meant to be inaugurated in March 2023. In August 2023 it is only halfway built (HotNews, 2023) and likely to remain the only token of an investment era which lasted from 2012 to 2021.

The successful completion of such projects would have rested on a mix of factors, none of which have been met in the case of Romania. Outside Victor Ponta’s premiership, there was an obvious lack of political willpower to see the projects through, while Chinese FDI ended up being channelled towards what were perceived as more relevant projects, mostly tied to the Belt and Road Initiative, which Romania never joined. Political instability played its part, but the systematic way in which those projects were redirected towards Western partners points to a clear tandem between the tightening geopolitical environment after the annexation of Crimea and especially after the election of President Trump to the White House in 2016 and Romania’s attitude towards non-Western involvement in its critical infrastructure sector. Viewed retrospectively, the 2012-2015 enthusiasm can be explained by a certain degree of strategic innocence in the case of the investment announcements of 2012-2015, fuelled by the general European trend which sought to court newly found Chinese economic prowess.

Other indices of closeness to China point towards a widening gap between the two countries. Romania joined the AIIB in 2018, three years later than most of its European counterparts and has not recorded any significant activity, with the first AIIB project in the country only commencing in July 2023 (AIIB, 2023). During the 2021 17+1 virtual summit attended by Chinese President Xi Jinping himself, Romania only sent a deputy minister, a clear diplomatic sign, joining five other states which willingly chose to downgrade their diplomatic presence at the summit, all part of the 2004 NATO cohort (Brinza, 2023). After the 24th of February, it became a 14+1 format, with the three Baltic states withdrawing from the initiative. For now, Romania seems satisfied with keeping the format alive out of inertia, after downgrading its diplomatic presence (Ciurtin, 2022).

On the internal political scene, none of the parliamentary parties mentions the PRC in their respective political manifestos, while parliamentary debates rarely mention the PRC, mostly in connection to the Sino-American competition (Ciurtin, 2023, p. 80).[1]

The current relationship is perhaps best exemplified by Romania’s 2020-2024 National Strategy for the Defence of the Country, as a reflection of Bucharest’s strategic thinking. China is only mentioned once, concerning the “USA’s pre-eminence in the international system […] and the way the USA perceive the systemic role of this state (nr. China) and answer to it”.

3. Small Blunders

A legislative initiative which secured the approval of the Deputies Chamber, Romania’s lower legislative chamber, was rejected by the Senate in unanimity on the 7th of February 2023. The law would have tied research funding to the absence of any legal ties with Confucius Institutes, which would have directly impacted the four state-funded universities which currently host such institutes (Bădică, 2023).

In July 2023 the Romanian Prime Minister signed a decree allowing Lenovo to participate in the country’s 5G network, with the caveat that the products commercialized under its brand are from economic partners security vetted according to the 2021 law mentioned above (Economedia.ro, 2023). The reasoning behind the decision to allow Lenovo’s participation was that the company is registered in Hong Kong, where the rule of law applies thanks to the One County, Two Systems principle. The governmental apparatus’s decision-making process is often opaque, a tendency most visible in the case of defence and security matters. The final decision was taken based on the advice of the Supreme Council of National Defence, which was used to justify the Prime Ministerial decree. While the legal reasoning is sound in theory, it is not clear yet how the provisions of the 2021 law will impact the Chinese tech giant’s involvement in the country’s 5G infrastructure.

Leftwing premierships have always been more sympathetic towards Beijing, such as was the case with Victor Ponta. In June 2023 Marcel Ciolacu from the Social-Democratic Party (PSD) took over from Nicolae Ciucă as part of a power swap deal with the National Liberals (PNL) with which it PSD currently governs. In August 2023, Prime Minister Marcel Ciolacu appointed former PM Victor Ponta as his economic advisor. While it’s tempting to extrapolate, viewing this through a strategic lens would be pretentious, to say the least. The decision is most likely motivated by political considerations on the national political scene, given that 2024 will be a busy electoral year featuring four rounds of elections. While Social Democratic governments, such as the Victor Ponta one, have traditionally enjoyed warmer relationships with the power in Beijing compared to the National Liberals, the recent inconsistencies are small in scale and are in line with the country’s political idiosyncrasies which lead to occasional unintentional strategic ambiguity, rather than symptoms of a wider strategic realignment.

4. Regional outlier or historical path dependency?

Romania’s relative immunity to Chinese interference stems from a complex historical path dependency. Outside the communist period, Bucharest’s foreign policy has been unequivocally pro-Western, motivated by a perpetual sense of uncertainty stemming from the East and, depending on historical contingencies, from one or more of its immediate neighbours. The country has a long history of intertwining infrastructure contracts with (geo)political aspirations. In the second half of the 19th century, on the back of the German Prince Carol I of Hohenzollern’s ascension to the Romanian throne, the first railway contracts were awarded to German companies in dubious circumstances (Mortu, 2023), part of a wider strategy to pursue a Westward looking modernisation process. The pattern was repeated throughout the decades leading up to the end of the Second World War when the Iron Curtain was lowered West of the country’s borders.

Starting with the second half of the 1990s, when Romania finally embarked on its transition journey to a free-market economy and a Western-leaning strategic orientation, it enjoyed a consistent alignment dividend on the back of a troubled vicinity. The decision to allow NATO troops and military hardware to transit Romanian territory during the 1999 Kosovo conflict was against the country’s long-standing friendship with Serbia but motivated by lust for NATO membership, a promise which was obtained less than three years later during the 2002 Prague Summit. The country spent the 2000s focusing on a profound structural adjustment process, which was crowned with the 2007 EU ascension.

When one looks at Romania’s neighbours, the alignment dividend becomes undeniable.

Ukraine’s standing was seen as generally pro-Russian until 2013, while after 2014 the very existence of the country was put under question due to Russia’s destabilizing actions in Donbass and the annexation of Crimea. Still plagued by historical wounds after the 1990s break-up of Yugoslavia, Belgrade’s duplicitous foreign policy proliferated during the 2010s, pulling it further away from the prospect of European integration. The position was “rewarded” with a flurry of opaque Chinese investment contracts in the country’s critical infrastructure, as well as Russian technological and financial involvement in the construction of the high-speed railway between Serbia and Hungary. Elsewhere in the Western Balkans, the decade leading up to the war in Ukraine saw a geopolitical vacuum on the back of an anaemic EU integration process, which has been mercilessly filled by Chinese companies offering dubious loans in exchange for opaque contracts with geopolitical stakes (Mitrescu, 2021). Under Prime Minister Viktor Orban, Hungary slid down an illiberal path with revisionist aspirations, tying more and more of the country’s critical infrastructure to Russian and Chinese investments. Bulgaria, another NATO and EU member, has always had a special relationship with Russia which fluctuated based on the government in power, even if Chinese attempts to penetrate the country’s ports did not yield noteworthy results. Moldova has always been a highly fragile state, marked by the Transnistrian conflict and culturally tied to Romania. Depending on the government in power in Chișinău, the country’s foreign policy has often been outright pro-Russian, as with the recent presidency of Igor Dodon. In turn, Romania’s unsatiable appetite for Western integration and security guarantees came from both an uneasiness stemming from the East, as well as an awkward position among its neighbours, exacerbated by Nicolae Ceaușescu’s isolationist regime and the chaotic transition of the 1990s. After the 2014 annexation of Crimea and the usage of military force in Donbas under the guise of “little green men” and the 2014 Wales NATO Summit which resulted in the prioritization of NATO’s Northern Flank, Romania’s geopolitical anxieties only grew stronger, solidifying its reputation as the most enthusiastic Euro-Atlantic supporter in the wider South-Eastern European region.

When it comes to the country’s relationship with the PRC, a conjoint process occurred in the country’s relationship with the PRC starting in the mid-2000s. On the one hand, China grew busier with asserting its role as a global power, switching its diplomatic focus from bilateral relations with peripheral states to Washington and Brussels. At the same time, Romania became engulfed in its European ascension process, which due to a delayed transition, featured an often-abrupt process of economic structural adjustment. Thus, the very modern economic fabric of contemporary free market capitalism in Romania was built around and determined by its geopolitical orientation. By the time that the populace’s purchasing power grew enough to allow for a diversification in consumption, near total economic alignment with the EU and more broadly the West was already cemented, leaving no significant space for a Sintic mercantile footprint.

On the other hand, the near total leverage possessed by the West in its relationship with Bucharest translated into a two-pronged integration pressure: even on the rare occasions when Bucharest did not see a strong enough alignment dividend, the highly complex issue linkage associated with pursuing integration into multiple international institutions – a process which is still ongoing – made strategic divergence near impossible. After securing NATO and EU membership, Romania is still chasing inclusion in the American Visa Waiver, a program from which Hungary has been recently excluded due to security concerns regarding what was in effect a passportization campaign aimed at ethnic Hungarian citizens in Romania, Slovakia, Serbia, Ukraine, part of a wider revisionist policy cantered around the Carpathian basin. Beyond that, Schengen and OECD ascension remain declared foreign policy goals which have yet to be attained.

Alongside geopolitical considerations, Romania’s economic structure acted as a barrier to significant Chinese involvement. SOEs have a large share in the economy and an even larger one when it comes to critical domains (OECD, 2023). The country has liberalized its gas and energy market only three years ago (ANRE, 2020) and has been particularly sensitive about its energy sector. In 2020 Romania adopted a memorandum to ban operators from non-EU countries that don’t have procurement deals with the bloc to speed up the construction of big projects like motorways. In 2022, it approved secondary norms (Kinstellar, 2022), which were extended in 2023 to cover EU investors (Bădescu, 2023), signalling a particular sensitivity about the country’s critical infrastructure that can often surpass economic considerations. Despite the troubled security environment in the Black Sea, the country’s offshore hydrocarbon deposits will be exploited by a joint venture between Petrom and Romgaz, leaving the Romanian state as a majority stakeholder (60%) after paying the American energy giant Exxon $1 billion for the initial investment since it acquired the perimeter’s exploitation rights in 2008 (Afanasiev, 2021).

The current lull in Sino–Romanian relations is due to a comfortable Chinese position thanks to a sizeable trade surplus, a certain nostalgia stemming from Romania’s mediating role in Nixon’s 1972 opening towards the PRC, and a lack of real strategic or economic stakes which would warrant a more abrupt diplomatic approach. The situation is perhaps best epitomized by a recent poll showing that 49% of Romanians consider the (lack of any concrete) Chinese influence a positive thing (Lupițu, 2022).

5. Conclusion

If Chinese efforts did not materialize during the general wave of Sintic mercantile optimism which swept the Old Continent in Xi’s first term, it is hard to see how they will in a tightening geopolitical environment.

At a regional level, the war in Ukraine and the volatile situation in the Black Sea have intertwined Romania’s security fate with that of a strong Euro-Atlantic world. In a geopolitical syllogism, this further entrenches a strategic reluctance towards Beijing, augmented by its cover support for Russia and overt attempts to destabilize and pick apart the Western-led international world. At a global level, the Sino-American politicization of trade and the relative EU awakening to the perils posed by acute dependence on China after the COVID and Ukraine war shocks strengthen the structural pressures pulling Romanian and Chinese interests further away. From Beijing’s perspective, double-digit growth a decade ago and a thirst to revenge the perceived century of humiliation made FDI a way to trumpet China’s return to the world stage. As the current economic downturn shows, picking sound investments has not been Beijing’s strong point. Appetite for further economic incursions abroad is kept in check by systemic economic weaknesses at home. For the foreseeable future, agential and structural factors will corroborate to calm down any attempts to perturb the current lull in Sino-Romanian relations.

Bibliography

Adevărul, 2012. Chinezii garantează realizarea hidrocentralei de 1 miliard de euro de la Tarnița. Adevărul.ro, November 25. Available at: https://adevarul.ro/stiri-locale/cluj-napoca/chinezii-garanteaza-realizarea-hidrocentralei-de-1-1493204.html

Afanasiev, Vladimir. 2021. ExxonMobil books $1 billion from divestment of Black Sea offshore project in Romania. Upstreamonline, November 3. Available at: https://www.upstreamonline.com/exploration/exxonmobil-books-1-billion-from-divestment-of-black-sea-offshore-project-in-romania/2-1-1092927?zephr_sso_ott=umtdj2

AIIB. 2023. AIIB Works with Banca Transilvania and IFC to Support Green Housing in Romania with Bond Investment Project. Asian Infrastructure Investment Bank, July 17. Available at: https://www.aiib.org/en/news-events/news/2023/AIIB-Works-with-Banca-Transilvania-and-IFC-to-Support-Green-Housing-in-Romania-with-Bond-Investment-Project.html

ANRE 2020. Piața gazelor naturale. Autoritatea Națională de Reglementare în Domeniul Energiei. Available at: https://arhiva.anre.ro/ro/gaze-naturale/informatii-de-interes-public/piata-gazelor-naturale

Bădescu, Georgiana. 2023. Hot off the press: Romanian FDI regime formally extended to EU Investors. Schonherr, June 9. Available at: https://www.schoenherr.eu/content/hot-off-the-press-romanian-fdi-regime-formally-extended-to-eu-investors/

Bădică, Petre. 2023. Senatul refuză, în unanimitate, să opreasăc propaganda Chinei din universitățile românești. Newsweek.ro, March 13. Available at: https://newsweek.ro/educatie/senatul-incurajeaza-propaganda-chinezeasca-in-universitatile-romanesti

Bernovic, Anca. 2014. Nidera Acquires USA/USC Terminal In The Port Of Constanta. The Romania Journal. December 22. Available at: http://www.romaniajournal.ro/business/nidera-acquires-usausc-terminal-in-the-port-of-constanta/

Brinza, Andreea. 2023. In our Out of the 14+1 Format, Romania’s Short-lived Romance with China is over. China Observers, June 29. Available at: https://chinaobservers.eu/in-or-out-of-the-141-format-romanias-short-lived-romance-with-china-is-over/

CDEP. 2021. PL-x nr. 161/ 2021. Available at: https://www.cdep.ro/pls/proiecte/upl_pck2015.proiect?idp=19269

Ciurtin, Horia. 2022. On the Future of 14+1: A view from Romania. China Observers, September 27. Available at: https://chinaobservers.eu/on-the-future-of-141-the-view-from-romania/.

Complexul Energetic Oltenia. 2023. GRUPUL ENERGETIC NR.3 ROVINARI – 47 ANI DE ACTIVITATE; GRUPUL ENERGETIC NR.7 TURCENI – 36 ANI DE ACTIVITATE. May 31. Available at:https://www.ceoltenia.ro/grupul-energetic-nr-3-rovinari-47-ani-de-activitate-grupul-energetic-nr-7-turceni-36-ani-de-activitate/?parent_page=142

Dan, Carol. 2012. O companie chineză investește peste 1 miliard de dolari într-un grup energetic nou la Rovinari. July 25, Mediafax Romania. Available at: https://www.mediafax.ro/economic/o-companie-chineza-investeste-peste-1-miliard-de-dolari-intr-un-grup-energetic-nou-la-rovinari-9901903

Economedia, 2023. România a autorizat compania chineză Lenovo să participe la rețeaua 5G din România. August 4. Available at: https://economedia.ro/breaking-romania-a-autorizat-compania-chineza-lenovo-sa-participe-la-reteaua-5g-din-romania-in-ciuda-legislatiei-create-tocmai-pentru-a-impiedica-intrarea-chinei-in-piata.html

Economica.net, 2023. Sebastian Burduja, despre proiectul hidrocentralei de la Tarnița-Lăpuștești. Agerpres, July 31. Available at: https://www.economica.net/sebastian-burduja-despre-proiectul-hidrocentralei-de-la-tarnita-lapustesti-a-venit-timpul-lui-romania-avea-datoria-sa-l-faca-de-acum-40-de-ani_684965.html

Euronews. 2022. Termocentrala Mintia, cumpărată cu peste 90 milioane de euro. Euronews Romania, November 15. Available at: https://www.euronews.ro/articole/termocentrala-mintia-cumparata-cu-peste-90-de-milioane-de-euro

European Commission.2020. EU foreign investment screening mechanism becomes fully operational. Available at: https://ec.europa.eu/commission/presscorner/detail/en/ip_20_1867

EXIM. 2020. EXIM Chairman Kimberly Reed Meets with Romania’s New Interim Prime Minister Nicolae Ciucă to Strengthen U.S. – Romania Economic Partnership and U.S. Energy and Infrastructure Export. Available at: https://www.exim.gov/news/exim-chairman-kimberly-reed-meets-romanias-new-interim-prime-minister-nicolae-ionel-ciuca#:~:text=Reed%20yesterday%20met%20with%20Interim,energy%2C%20transportation%2C%20and%20infrastructure.

Complexul Energetic Oltenia. 2023. GRUPUL ENERGETIC NR.3 ROVINARI – 47 ANI DE ACTIVITATE; GRUPUL ENERGETIC NR.7 TURCENI – 36 ANI DE ACTIVITATE. May 31. Available at:https://www.ceoltenia.ro/grupul-energetic-nr-3-rovinari-47-ani-de-activitate-grupul-energetic-nr-7-turceni-36-ani-de-activitate/?parent_page=142

Gov.ro. 2012. PM Victor Ponta: I want Romania to be China’s best friend in the European Union. September 30. Available at: https://www.gov.ro/en/news/pm-victor-ponta-i-want-romania-to-be-china-s-best-friend-in-the-european-union-a-political-economic-trade-cultural-and-artistic-gateway

Gov.uk. 2015. Let’s create a golden decade for the UK-China relationship. HM Treasury Speeches, September 22. Available at: https://www.gov.uk/government/speeches/chancellor-lets-create-a-golden-decade-for-the-uk-china-relationship

Hotnews. 2023. Chinezii au dat chix cu primul drum construit în România. Trebuia să fie gata deja. Available at: Infrastructura_articole-26398542-video-chinezii-dat-chix-primul-drum-construit-romania-trebuia-fie-

Ionescu, Adrian. 2022. Oportunități nucleare în Româna: Două companii americane, una canadiană și una franceză și-au anunțat interesul. Curs de Guvernare, October 27. Available at: https://cursdeguvernare.ro/oportunitati-nucleare-in-romania-doua-companii-americane-una-canadiana-si-una-franceza-si-au-anuntat-interesul.html

Kinstellar 2022. Romania approves secondary norms to its new FDI regime. Available at: https://www.kinstellar.com/news-and-insights/detail/1958/romania-approves-secondary-norms-to-its-new-fdi-regime

Lupitu, Robert. 2020. Ambasadorul Adrian Zuckerman și președintele EximBank SUA, în vizită la Cernavodă: Finanțarea de 7 miliarde de euro va asigura securitatea energetică a României în următoarele decenii, Calea Europeana. https://www.caleaeuropeana.ro/ambasadorul-adrian-zuckerman-si-presedintele-eximbank-sua-invizitala- cernavoda-finantarea-de-7-miliarde-de-euro-va-asigura-securitatea-energetica-a-romaniei-in-urmatoareledecenii/;

Lupițu, Robert. 2022. Sondaj îngrijorător: Din 14 țări NATO analizate, România este aliatul cu cea mai mare percepție pozitivă la adresa Rusiei și în care aproape 50% dintre cetățeni văd pozitivă influența Chinei. Calea Europeană, 29 September. Available at: https://www.caleaeuropeana.ro/sondaj-ingrijorator-din-14-tari-nato-analizate-romania-este-aliatul-cu-cea-mai-mare-perceptie-pozitiva-la-adresa-rusiei-si-in-care-aproape-50-dintre-cetateni-vad-pozitiva-influenta-chinei/

Mitrescu, Sergiu. 2021. A Dragon’s Quest in the Balkans. New Strategy Center Romania. Available at: https://www.newstrategycenter.ro/wp-content/uploads/2021/11/A-Dragons-Quest-in-the-Balkans-New-Strategy-Center-2021.pdf

Mortu, Alexandra. 2023. Afacerea Strousberg: Escrocheria unui industriaș prusac de care a depins Independența României. Adevărul.ro, May 6. Available at: https://adevarul.ro/stil-de-viata/cultura/afacerea-strousberg-escrocheria-unui-industrias-2264473.html

Nuclearelectrica. 2014. Selectarea investitorului pentru continuarea proiectului Unitatilor 3 si 4 CNE Cernavoda. Available at: https://www.nuclearelectrica.ro/2014/10/17/selectarea-investitorului-pentru-continuarea-proiectului-unitatilor-3-si-4-cne-cernavoda/

OECD, 2023. OECD Review of the Corporate Governance of State-Owned Enterprises in Romania. Available at: https://www.oecd-ilibrary.org/sites/fabf20a8-en/1/3/1/index.html?itemId=/content/publication/fabf20a8-en&_csp_=e34e86828c5a5ef41d3252bb7426c95e&itemIGO=oecd&itemContentType=book

Romania Insider. 2019. Romania Plans To Spend EUR 2.5 Bln To Rebuild Military Base At NATO Standards. September 24. Available at: https://www.romania-insider.com/romania-rebuild-mihail-kogalniceanu-military-base

State.gov. 2023. The United States and Multinational Public-Private Partners Look to Provide up To $275 Million to Advance the Romania Small Modular Reactor Project; United States Issues Letters of Interest for Up To $4 Billion in Project Financing. Available at: https://www.state.gov/the-united-states-and-multinational-public-private-partners-look-to-provide-up-to-275-million-to-advance-the-romania-small-modular-reactor-project-united-states-issues-letters-of-interest-for-up-to/

Șerbănescu, Liviu. 2013. Termocentrala Mintia: Investiții din China de 300 de milioane de euro. The Epoch Times. May 21. Available at: – https://epochtimes-romania.com/news/termocentrala-mintia-investitii-din-china-de-300-de-milioane-de-euro—192166.

World Nuclear News. 2015. Romania and China seal Cernavodă agreement. November 10. Available at: https://www.world-nuclear-news.org/nn-romania-and-china-seal-cernavoda-agreement-10111501.html

Endnotes

- For a detailed overview of political attitudes towards the PRC, please see Horia Ciurtin’s chaper in The People’s Republic of China: Political perceptions in Central Europe (ed). Patrick Triglavcanin, Foreign and Commonwealth Office. ↑